Florida’s unique climate and diverse ecosystems create a thriving environment for various exotic species. However, this biodiversity also increases the risk of exotic diseases affecting humans, animals, and plants. As these threats grow, understanding and managing these risks becomes crucial. One way to mitigate potential losses is through specialized insurance coverage designed to address exotic disease risks. This article explores the nature of these risks, the importance of specialized insurance, and how to choose the right policy for your needs.

Understanding Exotic Disease Risks in Florida

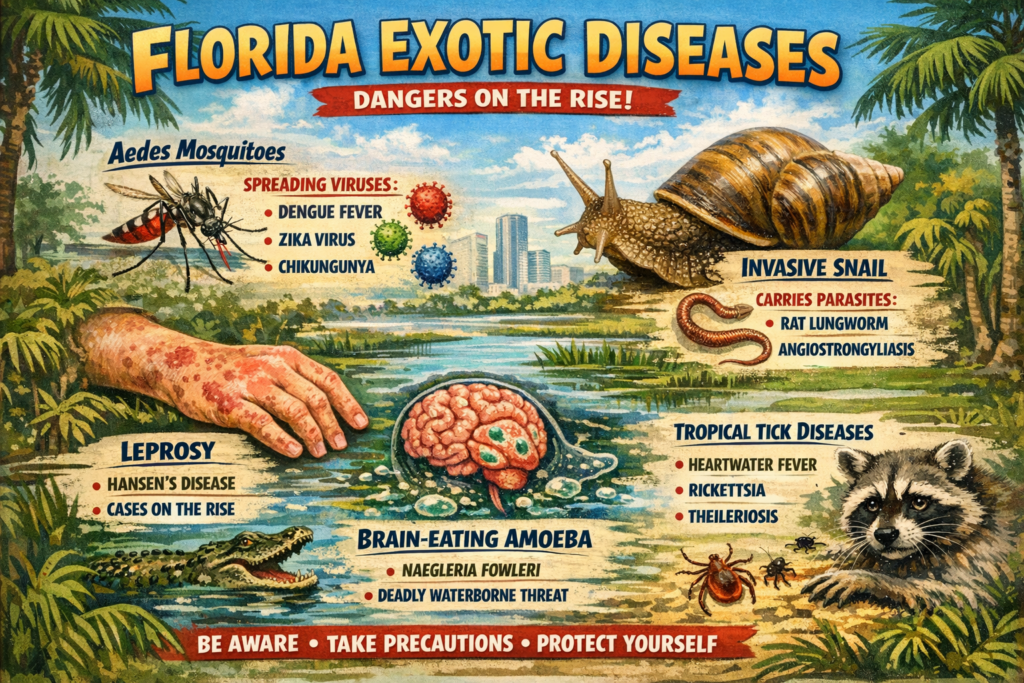

Florida’s warm, humid climate makes it a hotspot for exotic diseases. These diseases can be transmitted through various vectors, such as mosquitoes and ticks, which are abundant in the state. Diseases like Zika, West Nile virus, and chikungunya have made headlines, emphasizing the need for awareness and prevention. Furthermore, Florida’s role as a major hub for international travel and trade increases the likelihood of exotic diseases entering the state.

Agriculture, a significant part of Florida’s economy, is particularly vulnerable. The state’s farms produce a wide variety of crops that can be affected by exotic plant diseases. For example, citrus greening, a bacterial disease spread by the Asian citrus psyllid, has devastated citrus groves across the state. Such diseases can lead to massive financial losses for farmers and the wider agricultural community.

Moreover, exotic diseases can impact Florida’s tourism industry. Outbreaks of diseases can deter travelers, leading to a decline in tourism revenue. Thus, understanding these risks is essential not only for public health but also for safeguarding the state’s economy. Recognizing and addressing the threats posed by exotic diseases is the first step in managing their impact.

Importance of Specialized Insurance Coverage

Specialized insurance coverage for exotic diseases provides a financial safety net for individuals and businesses in Florida. Standard insurance policies may not cover the unique risks posed by exotic diseases, leaving policyholders vulnerable to significant losses. Specialized coverage can address gaps by offering protection against specific threats, such as crop losses or business interruption due to disease outbreaks.

For businesses, especially those in agriculture and tourism, having the right insurance can mean the difference between recovery and financial ruin. For instance, a farmer whose crops are destroyed by an exotic plant disease may face insurmountable costs without adequate coverage. Similarly, a tourism business hit by a decline in visitors due to a disease outbreak may struggle to stay afloat without financial support.

Furthermore, having specialized insurance can improve a business’s credibility and stability. Potential investors, partners, and clients may view comprehensive risk management, including exotic disease coverage, as a sign of a responsible and well-prepared enterprise. By investing in specialized insurance, businesses can demonstrate a proactive approach to risk management, ensuring resilience in the face of potential threats.

Choosing the Right Policy for Your Needs

When selecting an exotic disease insurance policy, it’s essential to assess your specific risks and needs. Start by identifying the primary threats to your business or personal assets. For instance, if you’re in the agricultural sector, focus on policies that cover plant diseases relevant to your crops. If you’re in tourism, consider coverage for business interruptions caused by disease outbreaks.

Consulting with an insurance professional who understands the complexities of exotic diseases in Florida can help you tailor a policy to your needs. They can guide you through the available options, ensuring you understand the terms and conditions of each policy. This expertise is invaluable in making informed decisions about your coverage.

Finally, regularly review and update your insurance policy to adapt to changing circumstances and emerging threats. The landscape of exotic diseases is dynamic, with new risks appearing as climates and ecosystems evolve. Staying informed and proactive in your insurance strategy will ensure you remain protected against the ever-changing nature of exotic diseases in Florida.

Conclusion

In conclusion, the risks associated with exotic diseases in Florida are significant and multifaceted, impacting public health, agriculture, and tourism. Specialized insurance coverage offers a crucial layer of protection, helping individuals and businesses manage these risks effectively. By understanding the unique threats posed by exotic diseases and selecting the right insurance policy, Floridians can safeguard their assets and ensure resilience against future outbreaks. Investing in the right coverage is not just a precaution—it’s a vital component of a comprehensive risk management strategy.